Lets look at the environment right now, because its not a pretty picture all around. Stock markets are down, crypto is way down, inflation is way up, and an international conflict is causing all sorts of problems across the world. This has led to a hobby downturn over the last quarter that looks to be the first true test of the boom since 2020. Crypto crashes have happened before and will happen again, and the stock market was up so big before, this could be a cooling period to reset things. Cards have been up, up, and very up during the last few years, and aside from a few small dips, have rarely had issues in the long term outlook. This looks a bit more serious.

In discussing the boom on this site over the last few years, I have mentioned that when things start to regress a bit, niche cards like WWE would be the first to feel the effects. Prizm was already coming down, but for the first time we are seeing most of the entire WWE spike cool a bit. This has sent some of the investors to the exits, but others have hunkered down a bit and bought the dip. Given that this economic and hobby downturn could be extended in length, here are some of the things I wouldnt sell off just yet.

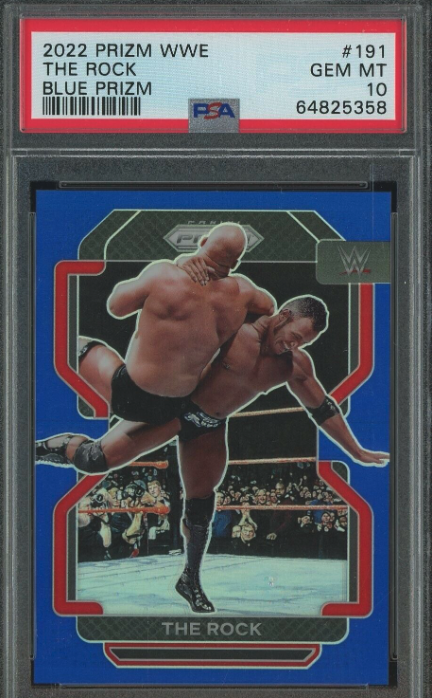

Anything of the Rock

This is one of my favorite subjects, because the Rock is the most famous person involved in the WWE market. He may not be the top wrestler of all time, but he is the most influential person to ever be involved in wrestling, having become the one of the most sought after movie stars in the world. He also has a TV show that chronicles his youth, and has been toying with a political career as well.

For this reason, he has become the most valuable wrestler in modern cards (he was a generation past everything vintage). Not only that, but his cards from Chrome and Prizm have set modern sales records across the entirety of this niche area of the hobby, and Im still confirming details on his 1/1 Prizm Black which has the potential to break every possible record for wrestling cards overall.

I dont think there will be any doubt that success in WWE hinges on the Rock, and his stuff should be held as tightly as possible – especially shiny stuff. With recent big sales in Goldin’s spring auction and gigantic $20k+ private sales of his Gold Prizms, the Rock has staying power that I dont think will ever be replicated. Unlike Hogan, he has very few of the outside of the ring issues that can limit potential, and his featured place atop US pop culture will give him legs that most wrestlers dont have.

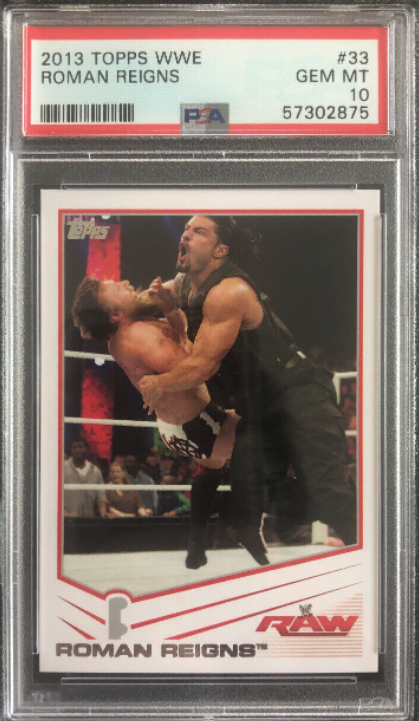

Big Wrestling Rookie Cards

One thing that has come with new people joining the WWE chase is that concepts from the big 4 sports have come along with them, including the increased value of rookie cards. The good thing about WWE programming is that it is designed to draw you in and create a week to week story you must follow. Cards have a very similar effect, and combining the two means that people will likely be sticking around with wrestling cards, even if the market dips.

I have collected sports cards since 1987, and I always loved the rookie cards of my favorite players, just like every other sports collectors. I was shocked to find out how much it wasnt a thing in WWE, as collectors seemed to value name and rarity over rookies. Now that this concept has changed dramatically, I dont think it will stop.

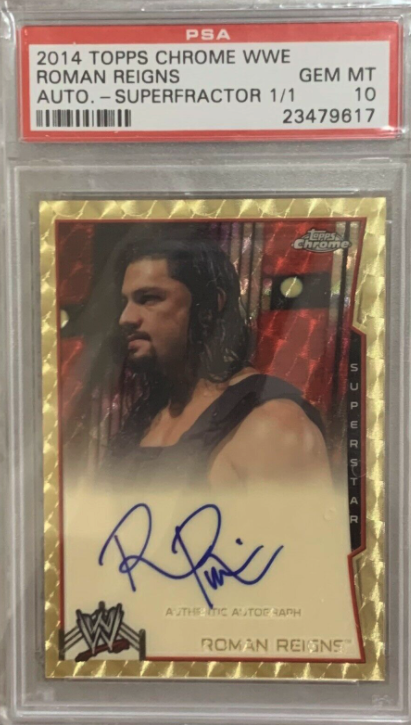

Sets like 2013 Topps, 2014 Chrome, and 2015 Chrome and Undisputed feature huge first cards of today’s top stars, and I see those being very valuable long term regardless of what happens in the economy. When the existing wrestling collectors started adapting their collecting habits to match incoming new eyes, the toothpaste was out of the tube – you cant put it back in.

Over the last year, I have seen rookies from Roman Reigns, Becky Lynch, Alexa Bliss, Sasha Banks and Seth Rollins shoot up in value, mainly because of how the market has shifted to be more focused on rookies, and these cards shouldnt be among any that snap downwards in value the way some of the lesser stuff might.

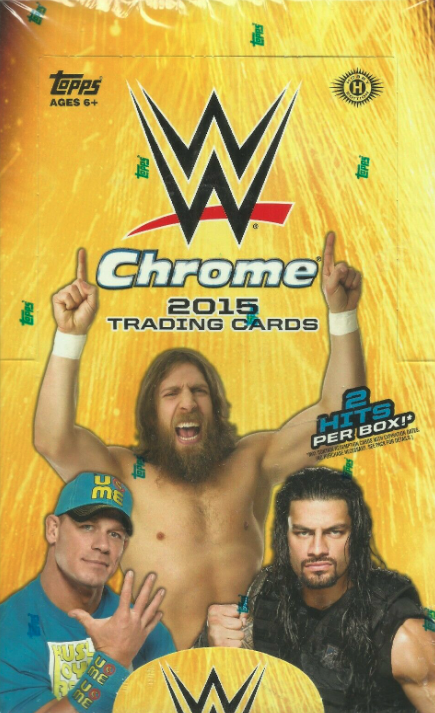

Unopened Chrome and Finest Wax

When Topps decided to invest in their WWE license for the first time back in 2014, they ran a test product in WWE chrome. It was released as standalone product for the first time, and offered the first all chrome set since the heritage sets in the 2000s. Because there wasnt an established legacy market yet for wrestling cards, pre-orders were small and the run was less than 300 hobby cases, with some estimates around 250. That’s the smallest run for any chrome product in the history of the brand.

Considering Chrome has been around for decades, the actual scarcity of the first standalone Topps Chrome branded WWE product is a huge deal. Its also why cards from the Rock and Roman reigns were setting records at the beginning of 2022. There just isnt any of this stuff to go around. Since the chrome spike started, box prices have gone from $100 to $1500 in cost, and the scarcity will prevent those original chrome boxes from dropping, regardless of what happens with the cards inside.

Similarly with 2015 Chrome, which was a larger set and a larger run, the wax has spiked to an insane degree. This set also features more modern superstars like Bliss and Flair, along side more fabled veterans like Rock and Hogan. There were more parallels available too, with Red Refractors, Atomics, and others making their first appearance. Even though there is a bit more of 2015 to go around, its still a minuscule amount compared to other sports. Like 2014, the actual scarcity will contribute to long term increases in value as people chase the big cards.

As Chrome came back to WWE with Finest in 2020, the legacy brands had a renewed interest with collectors and investors alike. For the first time, WWE wax prices SHOT up to double what they originally sold at, and have since doubled again. Finest was a new offering for WWE during that run, and with the Topps license ending in December 2021, it wont be made again until Fanatics takes back over in 2026/27. That creates a short run of both Chrome and Finest to drive up wax prices long term.

Superfractors and Prizm Blacks

Even before the boom came to WWE, the market was driven by rare cards. The rarer the card, the higher the expected value – just like in the major sports. The difference here is that the comparative value of the superfractors to other rare cards wasnt there. Now that the new crowd has invaded the ranks, they bring their affinity for shiny stuff to the market with them. Superfractors have shot up in value, because it is the card to own in many of the sports out there.

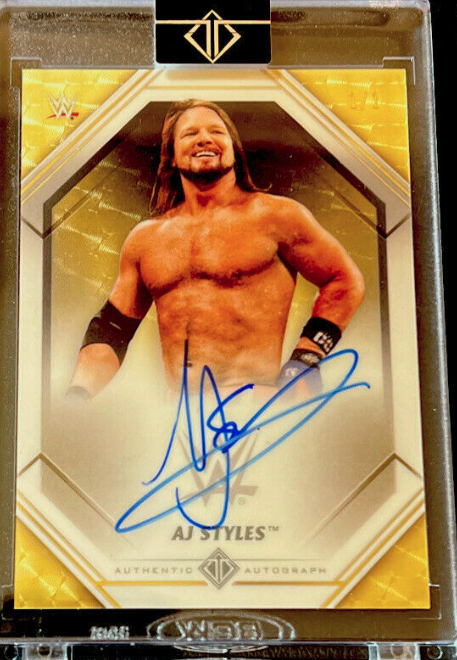

With the release of 2021 Transcendent, WWE was exposed to the first of the super-premium versions of the supers, and as expected, the market responded in kind. These cards are the nicest wrestling cards ever produced, and will sit at the peak of swag mountain for anyone holding them long term.

As 2022 Prizm hit the market, a new era of insanely valuable 1/1 cards came along with it, including public sales at and above $15k, as well as private sales well into the $20k range. When the Rock’s prizm black 1/1 eventually sells, it could be the among the most expensive wrestling cards ever sold.

Because these cards have legacy implications across the mainstream hobby, its clear that both the superfractors and Prizm black 1/1s will continue to have extreme value above and beyond other WWE cards, and even some of the major sports investment pieces. These cards are really the first modern examples to cross over, and I dont expect there will be an additional drop above and beyond what is happening in the greater hobby environment.

Big Transcendent WWE Cards

When Topps announced they were bringing the ultra premium Transcendent brand to WWE, I was floored. At the time this came around in 2019, the highest price a box of WWE cards ever sold at release was like $250, with Undisputed topping the charts every year. I never thought that anything in WWE would ever move with a box price of $12,000.

An interesting thing happened. Every break sold out, every box was opened, and Topps did three separate releases of Transcendent with three VIP parties to boot. Because Transcendent MLB has become a staple across multiple configurations, WWE Transcendent cards attracted an audience that wasnt focused on WWE. It also featured content that had never been offered before in the WWE market, with premium autographs, framed sets, and incredible looking unique cards.

We saw this explode in 2021 with the above mentioned superfractors, as well as 1/1 oversized framed art cards by Garbage Pail artists. Many of the top pieces sold for multiple thousands of dollars, despite the fact that the Panini takeover was looming. Because only 150 boxes of Transcendent were produced during the 3 year run, the set has a place that is unlike any other WWE product out there. More importantly, its likely that 95% of the wax has been opened, if not higher, which means sealed boxes wont exist the same way it does for other products. Every card is out there, every big hit has been pulled, and most of them are being held in PCs that will never see the light of day.

Because of that, many of these big Transcendent cards will achieve huge prices when they eventually do sell. To add fuel to that fire, every big name that has been a part of wrestling, except for the Rock, was in this set, including cut autographs of people like Andre the Giant and Macho Man.

The great thing about WWE is that so many of us grew up living in the world of wrestling, even if we left sometime during our transition to adulthood. That nostalgia drives a ton of buys in cards overall, and it wont be any different for these cards. The market will always have its ups and downs, but man, I hope people see past the dark clouds in the sky and realize there is still a lot of sunny days in the future.