Third party authentication and grading has been around for decades. It has also been a frequent target of mine because the service element of the model is so insanely ripe with conflicts of interest. When a service that is built around trust and expertise has no accountability and no regulation, and functions solely as a vehicle to make money, it shouldn’t be put on a pedestal as a gold standard. Yet, here we are.

Today, Logan Paul posted a video that confirmed what many had already started to suspect – the sealed case of first edition Pokemon cards were fake. Now, this is likely far from the first time that a sealed and authenticated item has been proven to be something other than what it was presented to be. On the other hand, this might be the most high profile version of it, and a black eye for what was a very respected expert in the space. More importantly, it goes to reinforce most of what I have said on this site for almost 15 years – the entire third party grading/authentication business is only as good as the people’s avoidance of scandal. More importantly, Logan Paul is a recent entrant into the hobby in general, and was acting on advice from other high profile hobbyists who were acting on advice from some other people, who may or may not have been duped themselves.

You know what all of this says about Logan Paul? Nothing. You know what it says about the hobby’s general trust for people who do this work? A lot.

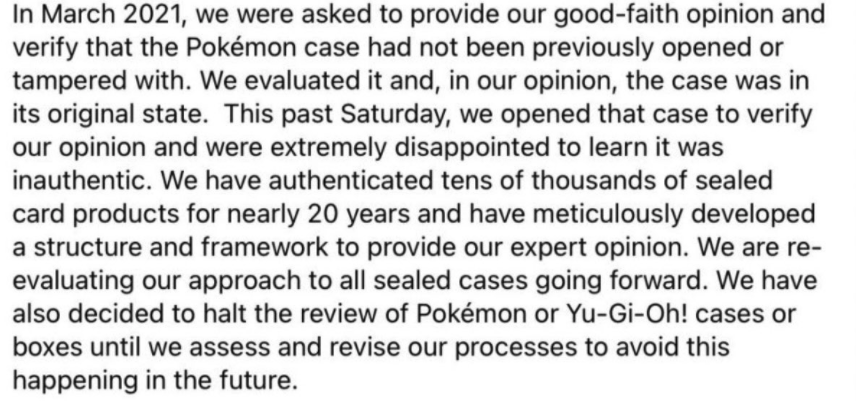

Like people trust PSA, BGS, and other companies as authorities, and add value to collectibles as a result, the same can be said about Baseball Card Exchange (BBCE). They are the foremost authenticator of sealed product in the world. They are trusted. They are experts as perceived by the people that use their service. However, they fell FLAT on their fucking face here. Not just because they were wrong, but because they chose money over due diligence. They chose to honor the words of people who stood to make six figures on the deal, rather than referring them to someone who knew what they were doing. They wanted to be involved with the highest profile Pokemon deal in history, over admitting that they lacked proper information to make an informed decision.

Here is their response, posted on the BBCE facebook page:

If you go back through all the scandals that have befallen this part of the hobby, and there are MANY, each of them follow the exact same path. A business, masquerading as a service, offers advice and imparts value on an item, regardless if their resulting opinion is accurate or informed. Sometimes its both, sometimes its one or the other, sometimes its neither. Regardless, there is no grading review body, or authentication review body, so the market tends to decide if they are worthy of continuing to hold a spot as a worthwhile participant in the cycle.

Historically, stakes were always high, but never high profile. Stakes were expensive, but not this expensive. Now, there are decisions being made daily that can impact lives, businesses, and reputations all on the shoulders of a third party being paid for an opinion with no accountability or transparency behind it.

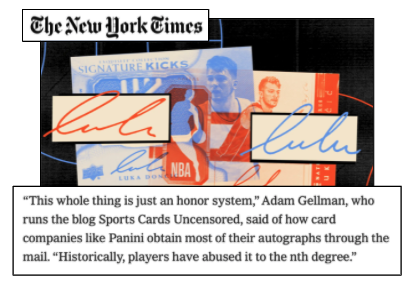

For many years, authenticating signatures, wax, and other collectibles has been big business, despite the fact that most of the main companies behind it have been targeted by authorities or indicted on federal fraud charges. This was before the hobby exploded, and before there were authentications and grades done in the millions of items each month. Similarly, just because the scale has changed, the giant conflicts of interest that existed then, still exist today. If anything, they have become more evident and important due to volume and value alone.

The companies will say that a market reaction is the only accountability they need, but this shows how far from the truth that is. It also showcases that maybe the people with the most to gain, also have the most to lose. To be frank, when new people enter a market with everything to gain and also everything to lose, weird shit seems to happen. This was the largest sale in Pokemon history, but it is preceded by two years of record breaking numbers representative of a speculative bubble.

Seeing that Logan Paul felt comfortable enough to spend 3.5 million dollars on this process is only representative of one thing, he was duped as much by the misrepresentation of a service as he was by the people involved. Watching his video, as well as the hundreds of Pokemon collectors who were speculating that this was fake all along, shows how out of their depth BBCE was. They didnt even do the simplest of research that others could do without even being in the room. Being that they KNEW the importance of this case, only further exemplifies the conflicts of interest that exist in the process.

I have written no less than a million words on the dastardly grading business and its lack of true accountability, but this one just makes my point in short youtube video. Enjoy the world we live in now, because it gets more and more complicated by the day.