The advancement of NFT (Non Fungible Token) technology into collecting has taken the world by storm. If you are unfamiliar with NBA Top Shot, or any of the major NFT platforms, its in your best interest to take a look at what the whole craze entails. Or, if you want a pretty hilarious shortcut, go check out this SNL skit.

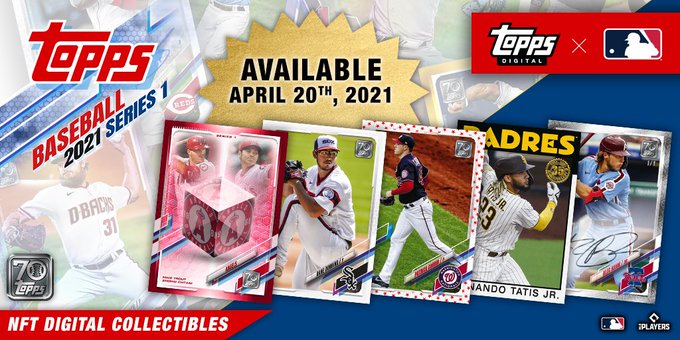

Topps recently announced that on April 20th, Series 1 Baseball will be released in digital NFT collectibles for the first time ever. This comes on the heels of the announcement of their going public through SPAC, based on the success of their business and digital capabilities. Because NFTs have already become a top digital collectible format across multiple markets, it should be no surprise that cards are a logical next step. This is ESPECIALLY true after the insane success of Top Shot.

Here is the announcement from Topps.

To give a bit of background, Topps has been doing digital collectibles for almost a decade now. Topps Bunt started the digital division over at the company, and that division has gained mainstream attention for the success they have had over the last 5 years, especially with Star Wars. Per the investor presentation, they did about 30 million in business in 2019, and are projecting 51 million by the end of 2022.

Just to make sure that everyone is aware, the way Topps Digital HAS done digital collectibles is not the way they WILL do NFTs, as the digital collectibles are entertainment and do not have ownership. NFTs by nature are owned by the consumer through the blockchain.

This whole concept is likely unfamiliar and unattractive to many long time physical card collectors, but I assure you that it has a gigantic market and a larger following. Sports Cards in general have exploded over the course of the pandemic, and NFTs seem to be on the same path. Like the card market, the bubble talk seems to have crept into the conversation, especially with the NBA top shot market cap drooping a bit as the market becomes more diluted.

I get it, honestly I do. People who have collected cards for 30+ years are hard to separate the physical nature of the ownership of their collections to a digital marketplace. From a manufacturer perspective, both Topps and Panini have embraced the digital side for multiple years and much success, likely as a pre-cursor to the blockchain technology that is needed to do this right.

People are like, why would I pay for a picture of a card on my phone, when I can just buy the actual card and own it physically? The reason is simple – both have intrinsic value in the secondary market. They may be different in nature, but both have value. I would say, if anyone is lucky enough to get a pack of the Topps NFTs announced today, they will see that the value of the digital collectible will FAAAAAAR exceed that of the physical one. Hard to wrap your head around how that is possible, but the easy explanation is the supply is far smaller and the demand is huge.

As Topps outlined, there will be two flavors of packs, a 5 dollar version available in 50,000 buys, and a 100 dollar version available in around 25,000 buys. Of course, like Baseball cards there are odds to pull rare chase NFT backed digital trading cards, which I would expect will go for an absolutely insane amount of money.

Here is the thing, Topps Digital built a large audience for their apps, largely composed of non-card collectors. A lot of the traffic, especially on the Star Wars and other entertainment apps, are not from the same target market as the physical card collecting public. One of the main reasons stems from the situation many of you find yourselves in right now – there just isnt a good understanding of why something like this is and should be valuable.

As recently as last year, the argument would have had some traction. None of the cards on Panini’s or Topps’ apps are owned by the people who buy them. The apps are meant for entertainment, NOT long term collecting. The NFTs are not only entirely different in that fashion, but can be traded across many platforms, sold easily, and can be produced without the same effort as a physical card. Additionally, with the finite resources for producing trading cards at full capacity, its clear NFTs have an advantage.

Because Topps Digital already has a huge infrastructure and support mechanisms for creating digital collectibles, this whole situation just sounds like a perfect fit. Even if there is a bubble that will drown the value of these cards eventually, right now the market is immeasurably strong. These cards will sell out lightning fast, and be worth a considerable amount of money. If physical collectors are willing to have an open mind here, they would see there is a lot of fun to be had, especially when you dont have to grade a card, wait for a big buy you make to come in the mail, or just want to see something explode. All of those things are native to this platform.