Part 1, discussing the first day of the release can be found here.

The release of Topps NFT Baseball is a new chapter for the hobby, even though it isnt the first NFT based collectible released in sports. It isnt the first blockchain based trading card either, as Panini has had those for a while. The main thing here is that this is the first crypto-currency backed full sports card release, and I have been fascinated by the entire thing. To be honest, I never expected to be engaged at all, but the intrigue was too much to sit on the sidelines. I wrote about my experience with the initial release, here is what has happened since then.

Understanding the Currency

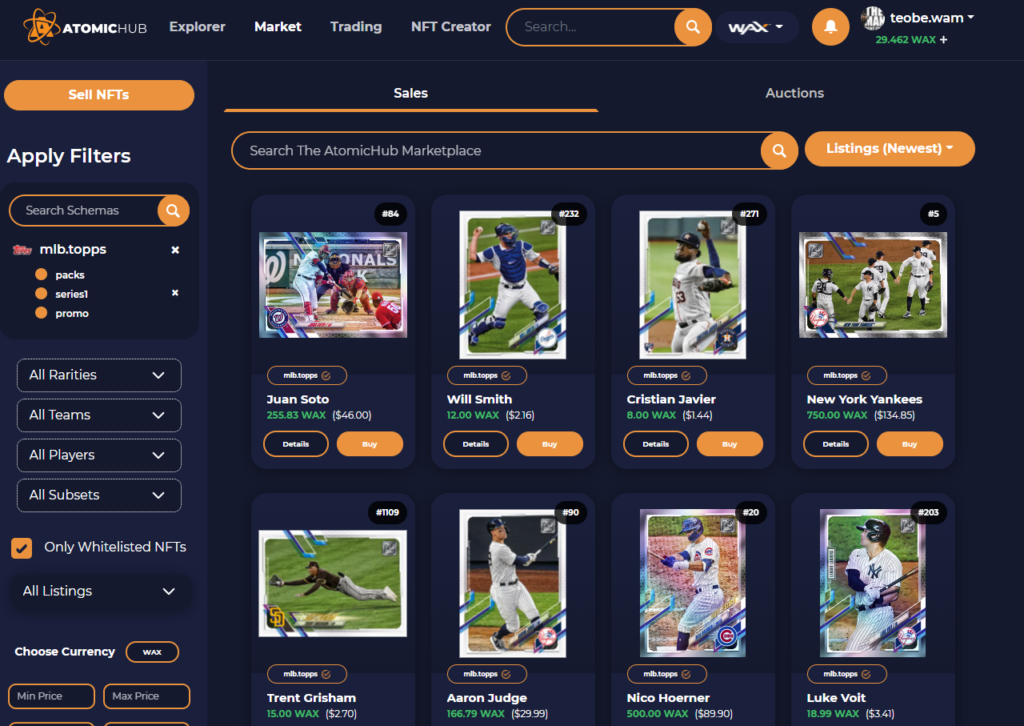

Unlike regular cards or even Topps Digital’s app based cards, these cards are DESIGNED to be bought and sold with ease. Well, that is, if you can find a way to get your hands on the crypto WAXP tokens that drive the sales of the cards. If you cant or wont get into the game, there are ways in through eBay, but the listings have shown to be with a premium attached. Eventually you will have to gain access through the currency, and that’s where this is going to lose a few people.

Being that I was in originally with a credit card to buy the packs, this step was already taken care of for me. Others, from what I have been reading on the forums and blogs, werent so lucky. They were either shut out of the packs, or they were unable to get a currency broker to work for them to transfer funds. It has created a huge barrier to entry in the market, one that will need some work for both Topps and WAX to overcome.

The second part I had to figure out was that the exchange rate of WAX to USD was a volatile measure, and always changing. Around the 24 hour post release mark, many cryptos decreased in value outside of their place in this release. This meant the WAX exchange rate became VERY favorable for many of the people who were waiting to buy in. Instead of paying .20 cents per 1 WAX, they were able to get it at as low as .13 per 1 WAX. Not only did this almost double their buying power, it changed the way people started behaving in buying the cards on the official market.

Eventually the exchange rate settled a bit, but I realized that it was important to use WAXP value as the standard for my buying early on. Using the volatile rate to determine how to engage with sales just became too difficult. I figured it would be easier to understand value if WAX became the standard.

The First Days on the Marketplace

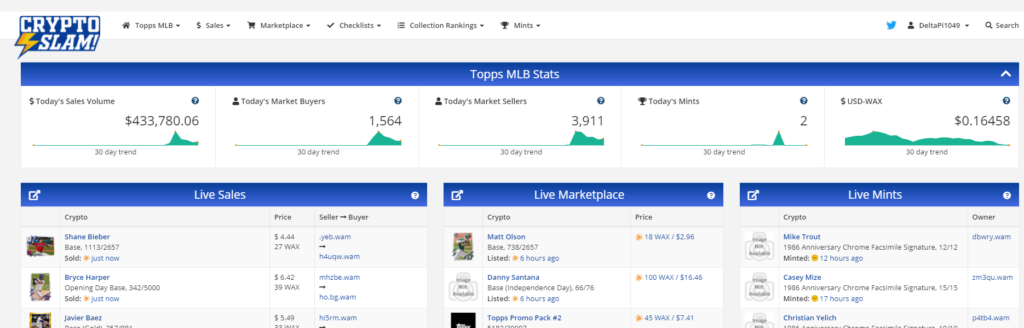

Ill start by saying, the way the market functions in the NFT space is what drew me to stay engaged. Because every transaction is visible on the blockchain, its easy to aggregate the information. Websites like Cryptoslam.io give a number of options to see and track sales, as well as showcase the size of the overall market.

In the past, Topps Digital has been insanely secretive of their stats for each app they already run. Things like Daily Average Users and user stats are hidden, instead governed by guesswork and a thing called “collection score” which does little to showcase where each user stands as part of the whole community. I have said on a number of occasions that Topps Digital is missing the one thing that could take their apps to the next level – major tracking of competition. With the release of the NFT, all that information becomes readily available.

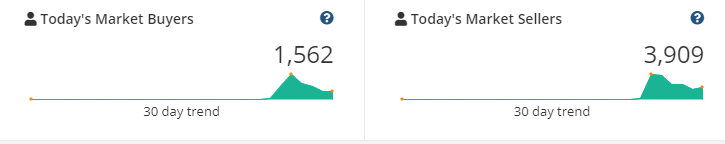

Taking a step back to the beginning, the entire marketplace started exceptionally hot, and it paid to get your cards listed first and frequently. After about 24 hours, things had dropped almost to 30% of where they started, somewhat driven by the lack of currency available, and the number of buyers who were willing to get in early. Now, almost a week later, the problems persist, and it shows in the fact that daily sellers outnumber daily buyers almost 2 to 1. Similarly, there are only about 9000 users that have bought something overall, with daily transactions slowing down to about 25k. Part of this can be expected with the fact that there has only been one release, but its clear that the value of certain parts of the set hasnt been on a growth trajectory.

Being that I had some experience with Baseball cards, I knew that value was going to be entirely dependent on one thing – how big of a deal the player is. If you are Mike Trout, there is no such thing as a bad investment in the physical cards, and that was obviously going to be the case in the NFT world. I knew there would be a strategy with players like Trout that was inevitably going to take over, so I tried to get in as quickly as possible.

Sales charts became my lifeblood, checking them multiple times per day, trying to get a handle on where things were going. Like the Topps Digital app marketplaces, the 24/7 nature of the sales process became a huge factor on deals. I found out that it was easy to make a mistake when listing a card, so I sold off a few big cards of no-name players and started watching the fresh listings come in. I was able to score a number of cards at half price, as people likely listed with a finger in the wind instead of checking the readily available data.

Wheeling and Dealing

My strategy was simple. Get enough WAXP to pull out my initial investment of 120 dollars from selling my junk. I had about 75 cards to start, and ended up selling most of them. This left me with about 4000 WAX to play with, as well as copies of the Trout, Tatis, and Acuna I pulled and decided to hold.

Because I was buying during the first major dip, the prices I was seeing made it very easy to get nice players and nice cards for nothing. Additionally, using my new listing trick, I made about 1000 WAX just picking undervalued cards off the new listing, and relisting them for the right price.

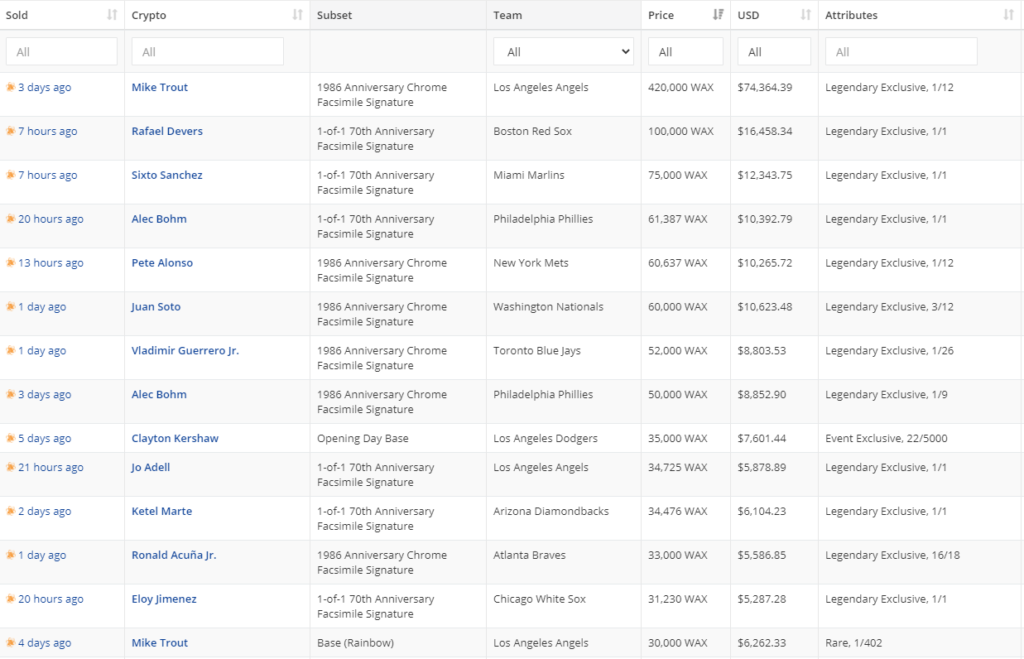

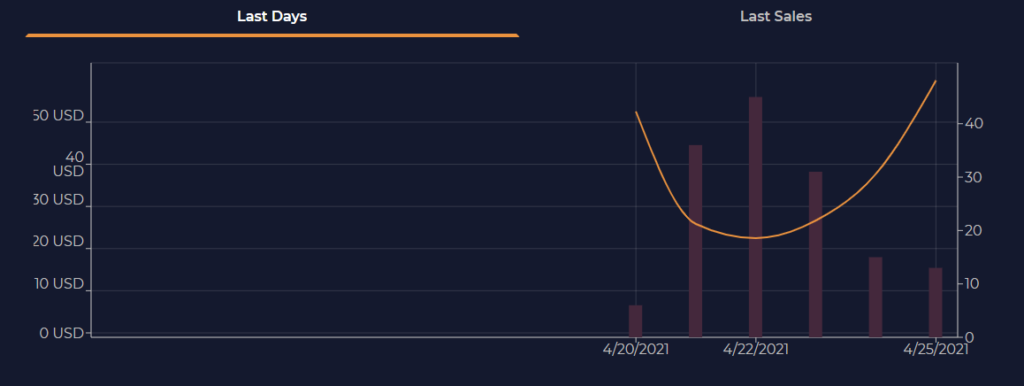

By the end of the third day, I ended up with quite a haul. I focused the ENTIRETY of my buying energy on Trout and Tatis, with some lucky Acuna and Soto purchases sprinkled in. All Trout cards spiked almost immediately once the market bounced back, giving me triple returns on my held cards in less than 72 hours. The rainbow rare Trout went from the 750 WAX I bought it for to settling around 2500. The Tatis rainbow I bought for 50 WAX settled over 400.

It was fun to see things settle the way I expected, and I felt like a Swami being able to call the trends before they started. In terms of value today, my zero dollar investment is now worth over 1200 dollars. In the grand scheme of things from people paying 5 figures for big cards, 1200 dollars isnt much, but it was fun.

Navigating Value of Certain Market Aspects

I found out there were a few things that migrated over from NBA Top Shot to create value in every area of the release. The main thing is that the lower mint numbers garnered higher prices. If someone posted a Mint #1 for sale, it would normally garner 300x the price a higher mint would go for. In fact, the top sale of the last week has been the Mike Trout Chrome 1986 signature, which sold for 80k at Mint #1.

Jersey number mints also create huge sales numbers, as well as huge misses. Huge sales for the sellers who pull them and list them appropriately, and huge misses for people who just didnt get the memo. The

There is also growing value in the unopened packs, something I knew was going to happen, but couldnt bear to wait on. The premium packs started on the secondary market at 300 dollars, dipped to 250, and then started climbing exponentially. At the time of this article, they are frequently selling over 600. As fewer packs remain sealed, these numbers will only go up.

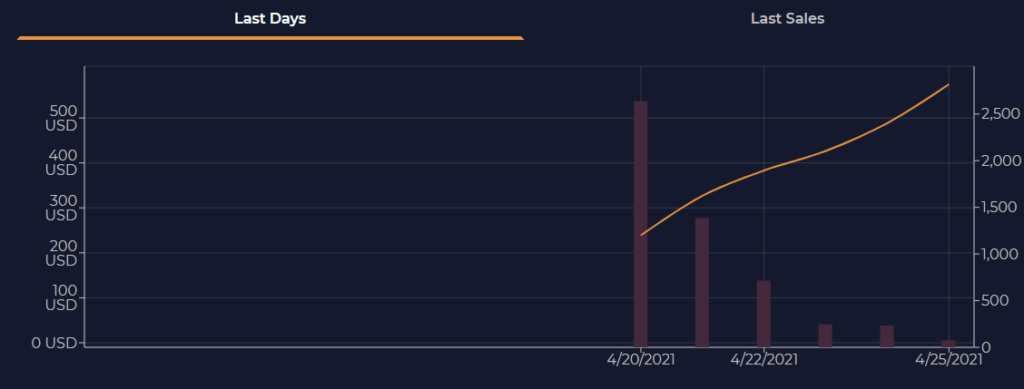

Here is the price chart for Premium packs, 62% of which have been opened. As that percentage climbs, the price will too.

Additionally, as more of the rare and desirable cards go into hold mode, the prices on available copies will increase. Garbage players have already started selling at 2x-3x where they were during the original dip, with exaggerated sales on the cards that are /76 and below.

Most importantly the big four continue to drive the growth in the marketplace. Even though total sales value has dropped significantly, numbers on the big four guys has done nothing but increase. Trout, Tatis, Acuna and Soto have gone bananas, especially the rare versions of their cards. Low mints for each can be in the four figure range for USD, and Trout is all but the entire top sales list.

Here is the Tatis Uncommon sales chart, you can see the way these sales have gone as available volume drops:

Rookies honestly havent caught on the way they drive things in the physical world, even though Alec Bohm and Jo Adell have seen some nice bumps since the original dips. If I was a guessing man, I would say this could be one of the first areas to change. I have a stash of both.

Overall Thoughts

I was not expecting to be as engaged as I am at this point, but the whole thing is addicting. As Topps releases more cards, whether another drop of series 1 or a new product, I hope they figure out the bugs. I would hope that a queue line would be established for pack sales, or at least a better way to distribute the traffic.

In terms of the market, the NFT market remains pretty predictable. Cards and packs that are desirable now, will only be more desirable as the entire things continues. If you are waiting to get in, these cards are not going to snap back to nothing, unless there is a Black Swan event.

Topps’ entire acquisition that spurred this release may have done so in an earlier fashion than expected, but its clear that there is a lot coming in this space. Obviously, there are a high number of physical collectors that wont get it, or dont want to risk it, but it will be something that continues to grow. Based on sales, Topps walked away with 3 million here, despite all the issues. The market is moving. Its only a matter of time before Panini and Upper Deck dive in as well.

If you dont feel like this is a big deal or something worth your time, I understand. Digital collectibles doesnt resonate with everyone who has lived on physical cards for decades. I must say, I am eager to see what is coming next.

i think it will have a niche that will probably grow, ill never do it. I have a teen age nephew who never read a newspaper and probably never will but he knows more about what is going on in the world than i did (even though i read the newpaper everyday) growing up